Table of Contents

- Why a Calm Budget Matters

- Money Stress Is Real

- Start With Familiar Habits

- Build a Layout You Can Understand

- Three Rules That Reduce Pressure

- Track Patterns, Not Every Dollar

- Weekly Money Reset

- Categories That Match Real Life

- When Budgeting Feels Heavy

- Try a Calmer Way to Budget

- More from the Intentional Living Series

- FAQs

Why a Calm Budget Matters

A calm budget is not about perfection. It gives you a clear view of your month and helps you make steady choices. When money feels uncertain, stress usually follows. A written planner gives your thoughts a place to land and makes financial decisions easier to approach.

If you want a simple way to begin, our Budget Planners include pages for income, spending patterns and monthly reviews. You can start any month of the year and adjust as you go.

If you enjoy gentle routines that keep you grounded, you may like What Routines or Habits Do Customers Build With Daily Planning?. It looks at how small, repeatable steps support consistency.

Money Stress Is Real

Many people feel pressure around finances. Surveys from the American Psychological Association show that nearly two thirds of adults say money is a significant source of stress. The worry often comes from rising costs, unclear spending and uncertainty about what is ahead.

A guide from Mayo Clinic explains that predictable routines can help lower anxiety, because the brain feels safer when it recognizes familiar steps. That applies to financial routines as well. When you have a simple way to check in with your money, it feels less like a threat and more like information.

A budget planner turns vague worry into something visible. When your mind does not need to guess what is happening, it can rest. That alone may reduce stress during busy seasons.

Start With Familiar Habits

You do not have to begin budgeting from nothing. You likely have small financial routines already. A calm budgeting process begins with what you are already doing, then organizes it so you can see it clearly.

Take ten minutes and write down:

- How you pay bills each month.

- Which balance you check most often.

- What you already track without effort.

- One money habit you feel good about.

Seeing these pieces on paper reduces mental strain. It also reminds you that you already have some structure in place. The planner simply gives it a home.

Build a Layout You Can Understand

A budget planner works best when the layout matches how your mind processes information. Many people stay more consistent with simple pages that ask only one question at a time.

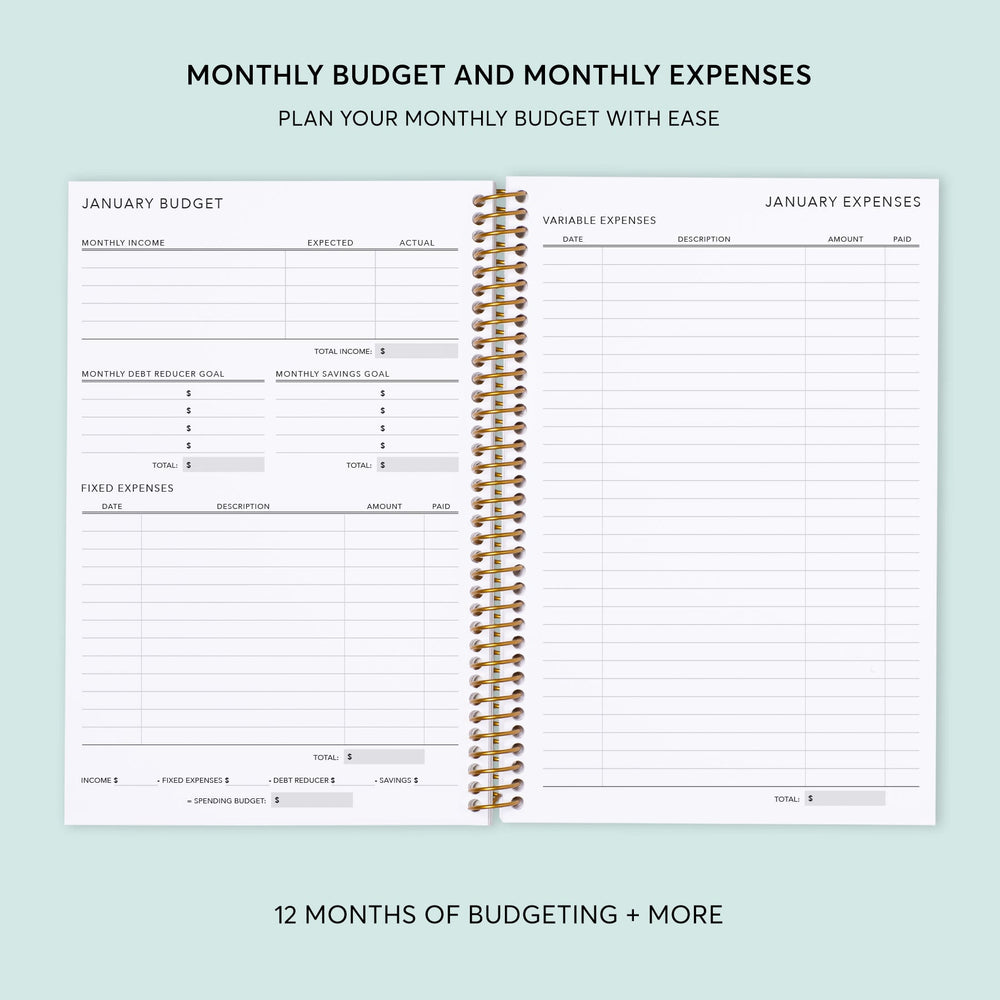

A basic layout inside a Posy budget planner may include:

- A monthly overview of income and key expenses.

- A list of recurring bills.

- A flexible spending page for groceries or household items.

- A notes section for next month or reflections.

Research on habit and behavior from the University of Cambridge highlights that repeating the same small steps in the same context helps those steps become automatic over time. A clear layout supports that kind of repetition, because your brain knows where to look.

If you prefer planning at a slower, steadier pace, you may also like In a World That Moves Fast, We Still Believe in Slowing Down. It explores how pacing your decisions supports a calmer mind.

Three Rules That Reduce Pressure

Rule 1: Plan for Your Real Month

Write how your month actually unfolds. Include coffees, school costs, small treats and family activities. These details give you patterns, not judgments. Once you see the patterns, you can decide what to keep and what to change.

Rule 2: Expect Change

Budgets that never change rarely last. Prices shift and life seasons change. Adjust numbers when you learn something new. Flexibility is part of calm budgeting, not a sign that you failed.

Rule 3: One Focus at a Time

Research in behavior change shows that people follow through more often when decisions are simplified instead of expanded. One focus per week, such as watching groceries or checking balances, is usually easier to maintain than trying to track everything at once.

Track Patterns, Not Every Dollar

Tracking every purchase can be helpful for some people, but it can also lead to burnout. A calm budgeting system gives you more than one way to track.

Try one of these approaches:

- Track only the categories that create the most stress.

- Use weekly totals instead of daily logs.

- Write starting and ending balances for each account once a week.

The Consumer Financial Protection Bureau suggests that even simple spending trackers can help people see where money is going and make clearer decisions. You do not have to log everything to get a helpful picture.

Your Weekly Money Reset

A weekly reset keeps your budget current without asking for daily attention. Ten to fifteen minutes is usually enough to feel informed.

Use your budget planner to check:

- Which bills were paid or scheduled.

- Current balances for key accounts.

- Category totals for the week.

- One financial win from this week.

- One focus for the next week.

Habit research summarized in behavior change literature shows that repeating the same brief steps each week helps the brain form more stable habits. Consistency matters more than volume.

Categories That Match Real Life

Many budgeting templates list categories that do not fit real life. It is easier to stay engaged when categories match your situation.

Core categories might include:

- Housing and utilities.

- Groceries and essentials.

- Transportation.

- Debt or payments.

- Savings or emergency fund.

Personal categories that can add clarity:

- Kids or school costs.

- Health.

- Pet care.

- Support for others.

- Joy fund or discretionary spending.

If you like digital tools as a companion to paper, the Budget Planner from the Financial Consumer Agency of Canada gives an example of how categories can be grouped and viewed over time.

When Budgeting Feels Heavy

There will be days when you do not feel ready to review your numbers. That experience is common. Instead of stopping completely, you can offer yourself smaller steps.

On harder days, try one of these:

- Write today’s date and one sentence about how you feel.

- Check only your main account balance.

- List three financial tasks you managed this week.

- Set a five minute timer and focus on one category only.

- Move tasks forward to next week if you need more space.

Some people find it helpful to pair a budget planner with a Gratitude Journal. Writing one thing you are grateful for each day can soften the emotional weight of money decisions.

Try a Calmer Way to Budget

You do not need a perfect system. You need a place to begin and a rhythm you can keep. A written budget helps you respond instead of react, adjust when needed and see progress over time.

Explore our Budget Planners handcrafted in our Vancouver studio. If you like to plan meals alongside spending, our Meal Planners can support your weekly rhythm.

More from the Intentional Living Series

Frequently Asked Questions

No. Many people do well tracking only a few categories or using weekly totals. The goal is awareness, not perfect records.

Yes. You can start on any day. Beginning when you feel ready often leads to better consistency than waiting for the first of the month.

A weekly check in works well for many people. You can add a quick monthly review to look at patterns and adjust categories.